August 09, 2023

Weekly Market Outlook

By Donn Goodman and Keith Schneider

It appears that the Markets are trying to digest the latest data, economic inputs, and newsworthy items. We want to take a look at a few of these and determine what, if any, effect they may have on the markets in the near future.

Please note that we have officially started the summer malaise. This is the time of the year that markets experience less volume, more volatility, and potentially subpar performance from the indices. But first, let’s examine the big data points from this week.

1. FITCH U.S. Credit Downgrade.

By now, most of you know that one of the big three ratings agencies, FITCH, cut the credit rating for the United States from AAA to AA+. This was a notch down in the US credit rating by Fitch.

This action was immediately met with higher interest rates across the curve. The two most watched longer-term US Treasury 10-year and the 30-year bonds both climbed higher. Both instruments broke through their long held resistance (for the 10-year this was the pivotal 4.0% barrier). The 30-year climbed 9 basis points to 4.10 in Asia on Tuesday afternoon.

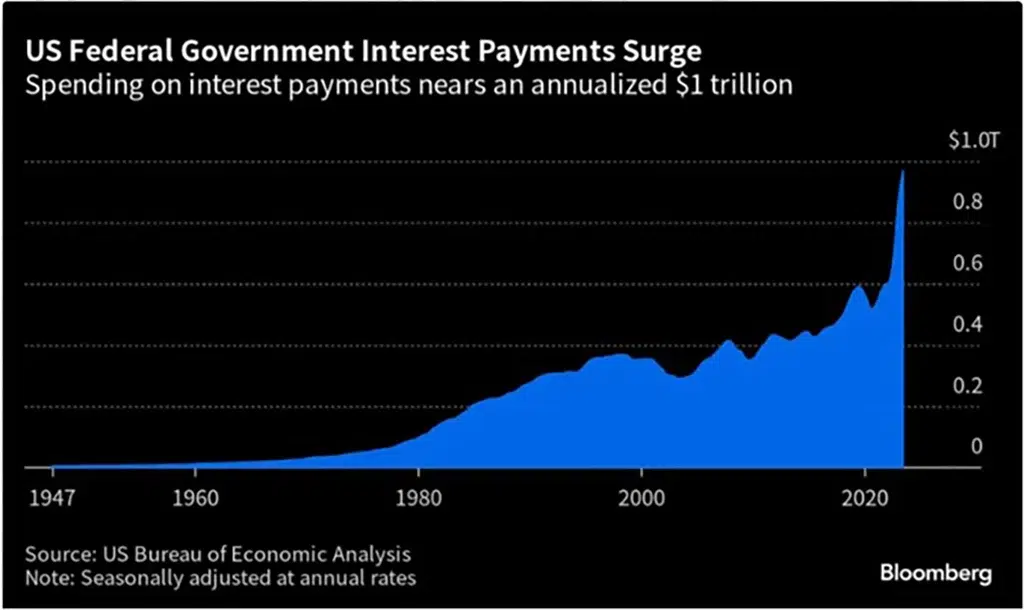

Fitch said that tax cuts and new spending initiatives, along with several economic shocks, have pushed up budget deficits. The rating agency voiced concern about the sustainability of the interest payments on our current debt, which are approaching $1 trillion and climbing. See chart below:

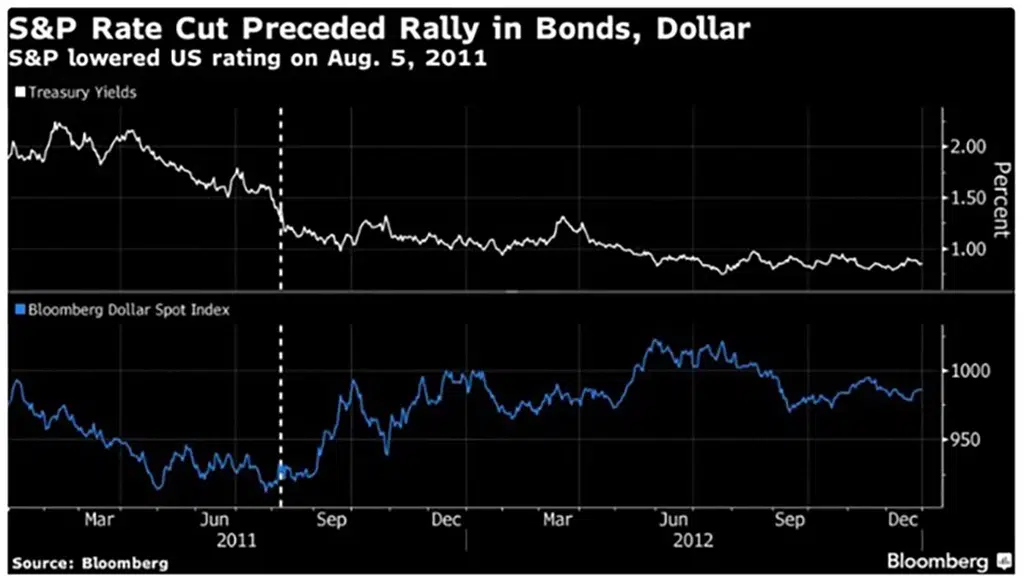

The move follows a decision by S&P Global Ratings to downgrade the US from its top tier in 2011, and leaves Moody’s Investors Service as the only one of the main ratings agencies to keep the nation at its highest level.

In their statement, Fitch offered the following:

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades,” That erosion in governance “has manifested in repeated debt limit standoffs and last-minute resolutions,” the ratings company said.

My initial thought was, “what took them so long”?

Prominent economists Larry Summers and Mohamed El-Erian joined a cohort of their peers in criticizing Fitch Ratings’ decision to downgrade the US given signs of resilience in the world’s largest economy.

What Bloomberg Strategists Say…

“There shouldn’t be much lasting impact on Treasuries as Fitch put the US onto a stable outlook from negative. That means another move is very unlikely — it’s a one-and-done operation and marking to market with S&P’s AA+ rating.”

As you can see from the below chart, the last credit downgrade in 2011 by Standard & Poor’s had little lasting effect on higher Treasury rates afterwards:

At the end of the day, most economists’ prognosis of the Fitch cut is that it may have little effect on US Treasuries. The US sovereign rating may have slipped, but Treasuries remain a buy.

2. Debt is beginning to alarm more than the ratings agencies.

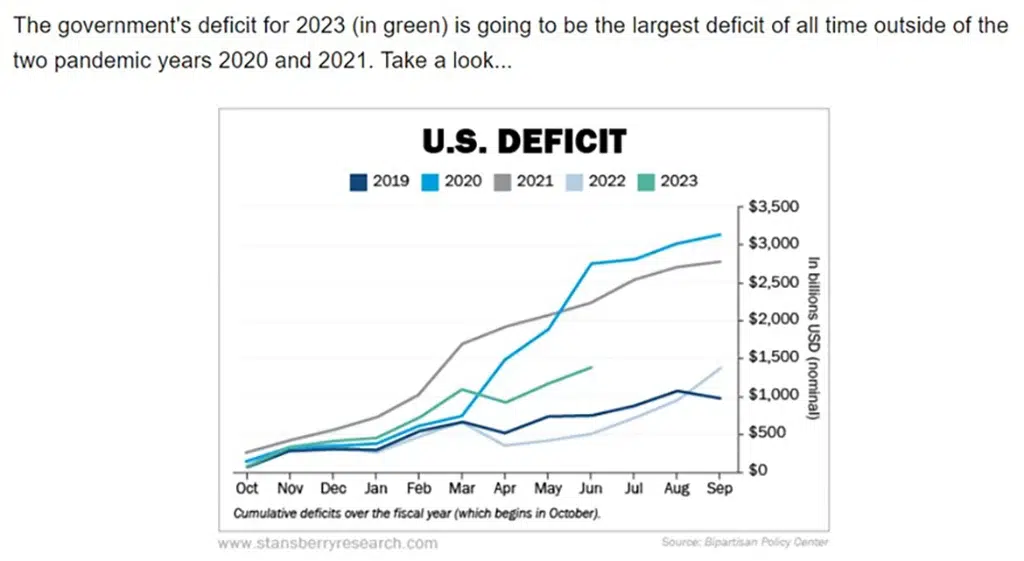

Part of the issue that Fitch has, along with the other rating agencies, is not only the growth of interest payments on that debt, as stated above, but also the ever growing deficit. Outside of Covid and the 2020-2021 pandemic, 2023 will be the largest deficit in history. See chart below:

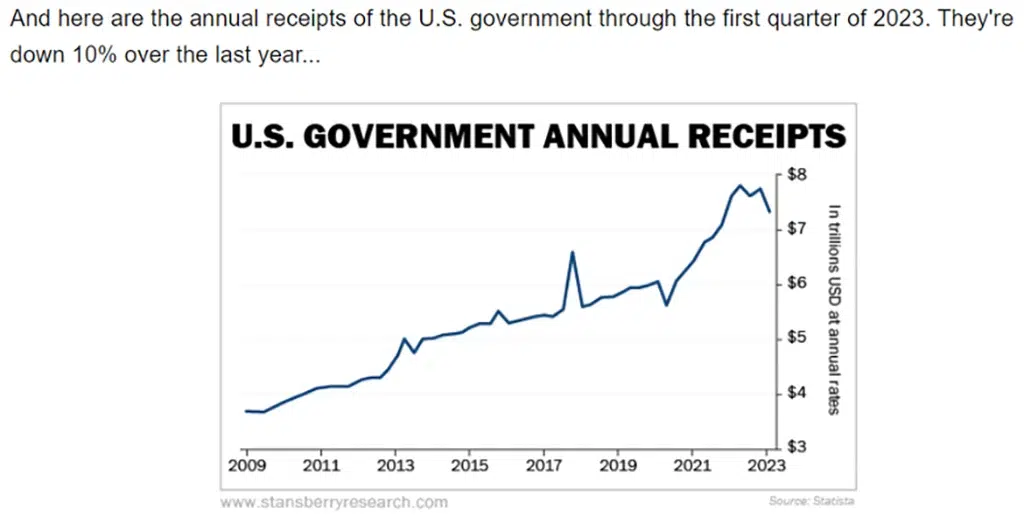

While the economy is on better footing since the Pandemic, the government, with its many social spending issues, has continued to spend money well above the budget, at an alarming rate. Revenue receipts this year by the Government are expected to fall a minimum of 10%, exacerbating revenue shortfall projections. See the revenue projection chart below:

**************

Discover Your Investing Strengths

Are you investing in a way that leverages your strengths? These 10 simple questions will uncover how to approach the markets in a way that plays into your strengths so you succeed faster and with less effort.

**************

3. 10-year Treasuries cross the 4.0% barrier.

Perhaps even more impactful this week than the actual ratings cut was the spike in rates of the US Treasuries. Thursday, the 10-year hit 4.18% marking an eight-month high. See graph below:

Crossing the 4.0% barrier on the 10-year may put a short-term buffer on the stock market. You might notice the last highs in interest rates came in October, 2022 and were in line with new lows on the S&P 500 index.

We have shared with you in recent Market Outlooks that during 2022/23 when the 10-year Treasuries wandered above 4%, it halted stock advancements. This week was no exception. The S&P 500 index was down 2.2% for the week while the Dow fared a bit better only down -1.1%. However, the tech heavy NASDAQ 100 (QQQ) was down about 3%

A move higher (and breakout) in US Treasury rates puts pressure on stocks as some investors (and institutional funds) will move assets to higher yielding Treasuries and corporate paper which attracts capital at these higher rates. Also, Wall Street analysts who are the architects of sophisticated earnings models, have to adjust their earnings models to include higher interest rates. That usually means that they will use lower P/E multiples for a fair value calculation. They then get the message out that they are adjusting their price targets down a bit to incorporate the cost of debt. Higher interest rates can negatively affect the expected price of a company’s stock in the future. We are beginning to see adjustments made during this earnings season.

The 30-year Treasury chart below shows its breakout from this week:

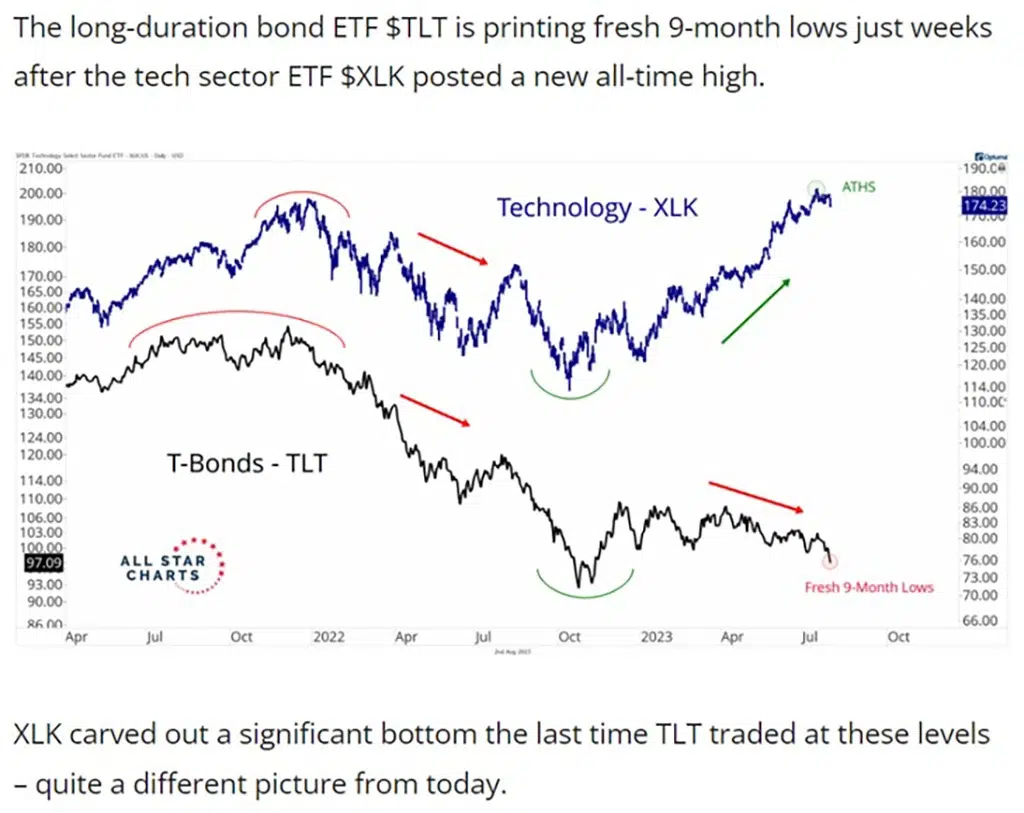

We have also commented previously that several sectors, including technology stocks (XLK) recently posted a new all-time high. It is typically that when these things happen, they are ripe for consolidation or correction. Today, with bonds reaching new lows (and higher interest rates), it will likely apply short-term pressure on sectors that were fueled higher by a recent rally in bond prices (and lower yields).

Others, like LPL Research, believe that we are likely making a double bottom in the TLT’s and that this is typically what happens 5-6 months before a possible recession. Their expectation is that rates will come down and propel stock prices higher over the next 12-18 months (after a soft landing or mild recession).