Weekly Market Outlook

By Donn Goodman

January 03, 2023

To all our readers, near and far (we have many important subscribers in other countries), THANK YOU for making us part of your weekly market review during 2023.

Hopefully, reading this Outlook and Mish’s Daily has helped you navigate the volatile markets this past year. (if you don’t regularly receive either of these, please go here and sign up to receive Mish’s Daily and this Market Outlook).

More importantly, if you are one of our many subscribers that utilize the MarketGauge strategies to help you manage your investment portfolio more effectively and efficiently, we hope your results were as good as our models’ – most of our strategies had a very good year.

(This is why we recommend all of our investors use a blend of our strategies for a more consistent and improved return)

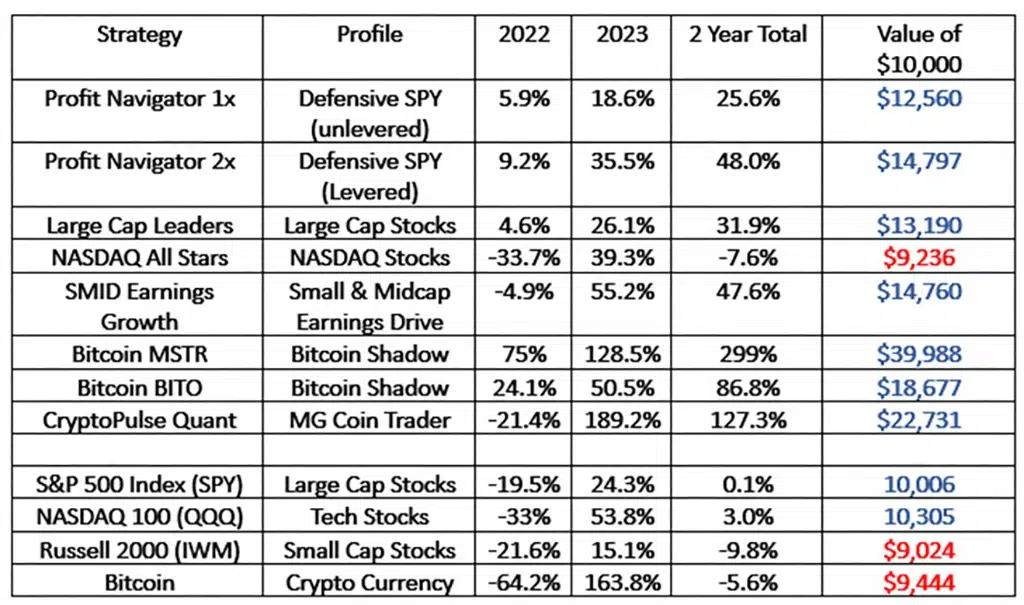

These strategies also had a solid year of gains during the down market in 2022. For a look back over the past two years, we offer the following table of returns (your results may be different depending on when you took the signals. All MarketGauge.com signals were predicated on market on open orders, and targets and stops were taken when the signal was generated)

Of course, these numbers do not include trading fees, commissions, or asset management fees that a money manager might charge. But there is a WOW factor in the easy-to-follow MarketGauge strategies that we offer and that our subscribers are easily able to execute (we have heard from several of you reinforcing the good year that you had).

We are greatly indebted to our fellow team members, James Kimball, and Holden Milstein, who have developed, tested (and retested), managed, and monitored all the algorithms and systems in order to help you, the subscriber, follow along and hopefully have similar or even better results than those listed above. For Profit Navigator above, we also make available an option strategy that allows subscribers to use options that have demonstrated a high win ratio and meaningful gains.

If you would like more information on any of the above MarketGauge strategies for subscription purposes please contact Rob Quinn, our MG Strategy Consultant at Rob@MarketGauge.com.

A look back at 2023.

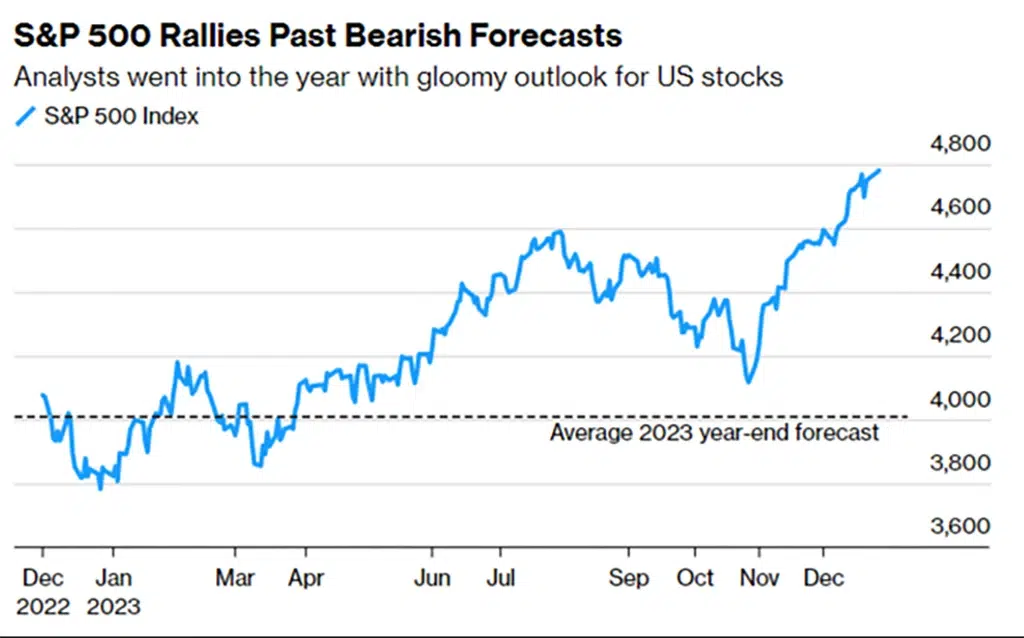

Heading into 2023 from the dismal markets of 2022, the average forecast from the “street” was for the S&P to close around 4,000. Friday, the S&P 500 closed at 4,760 and less than 2% from a new all-time high. In other words, we closed 19% above the average Wall Street’s average year-end target.

It is important to point out that just 2 months ago, the S&P 500 was trading at 4100 and in-line with the average year-end forecasted target. Institutional investors were bearish and defensive towards the end of October.

In early November, Jerome Powell and the Federal Reserve went beyond halting rate increases and made an “about face.” Due to this Fed Pivot of a possible 3 interest rate cuts in 2024, institutional investors put much of their cash sitting on the sidelines to work quickly.

Tracking the inflows, it was apparent to get this money invested quickly, many institutional investors (and retail) just bought the very large and liquid major indexes. November and December, experienced record new money in flows, especially into the cap weighted S&P 500 index.

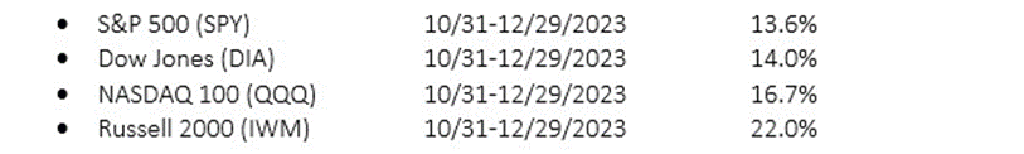

Because of the “Fed Pivot”, the markets went well beyond the average forecasts and rocketed higher. Here is the 2-month performance of the four main indices.

Here is what the S&P 500 looked like for the last two months (60 days) as the market surpassed the average Wall Street forecast. See graph below:

Because of the steep and almost parabolic move higher, most analysts now believe that the stock market is pricing in not 3 rate cuts in 2024 but more like 6-7. We agree with them that the market has gotten well ahead of itself.

The only way that we see more than 2 or 3 Fed rate cuts is if the economy slows much more than expected and we go into a mild recession, or some exogenous event (War) occurs.

That is not in our crystal ball and certainly Mish shares in this being a way too optimistic and rosy interest rate scenario. If anything, we believe that just like the 1970’s, it is possible that inflation picks up in the next few months and stalls an early 2024 interest rate cut in March as many pundits are now expecting.

Use the link below to continue reading about:

- Growth vs. Value

- The Election Cycle

- What’s in Store for 2024

- The January Effect

- The Magnificent 7 Valuation Disparity

- The Big View Bullets

- Weekly Video Analysis

- And more