November 22, 2023

Weekly Market Outlook

We wish Southern Boating readers a very Happy Thanksgiving Day!

We hope that you enjoy this day of gratefulness with family and good friends. We thank you for checking in with us and reading our investment overview each week. We look forward to continuing to earn your trust and loyalty.

We also hope that you have had a prosperous November while these markets have recovered from their October weakness. The MarketGauge investment strategies have had a positive 2023. Almost all of our offerings have exceeded their respective benchmarks. We would like to share their performance with you. If you are interested, please reach out to Rob Quinn, our investment product specialist and he can go through our available strategies, including the crypto and crypto ETF strategies if you are interested. Rob can be reached at Rob@MarketGauge.com.

You may not be aware that several of our strategies are up over 20% and more year-to-date. We even have a stock strategy up approximately 40% year-to-date that doesn’t use riskier option strategies to do it. Make sure you check in with Rob. He can provide you with all the details.

Cooling inflation numbers fuel a big bull market day a week ago last Tuesday.

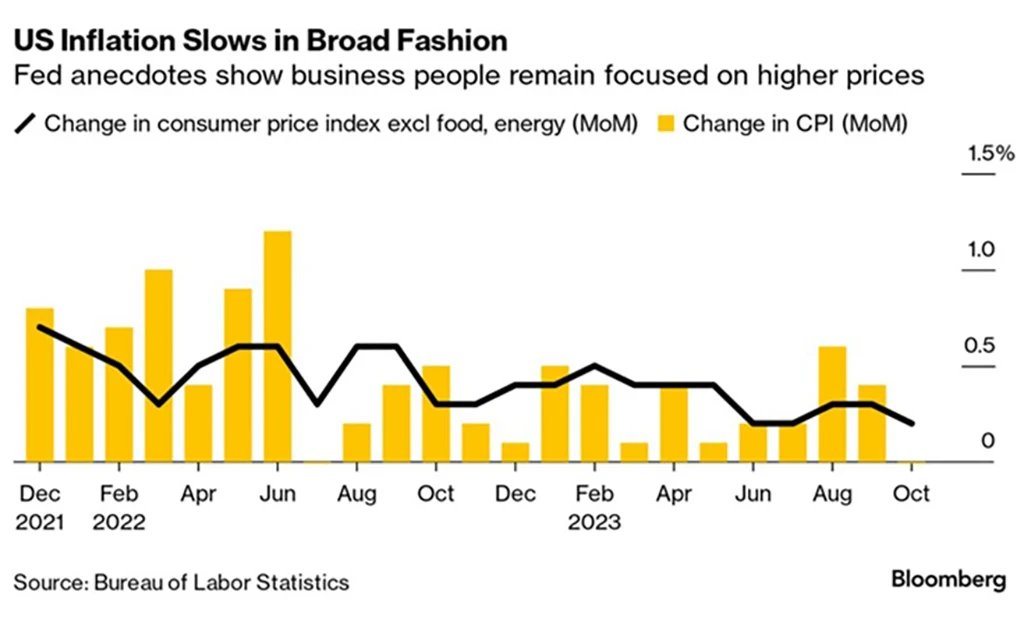

Last week, the CPI came out lower than expected (Core inflation stayed the same) and relieved investors of the potential pressure that the Fed may hike rates at their meeting next month. See chart below:

This also caused the US Dollar to sell off as money fled safe havens and found its way back into risk assets, higher yielding bonds and equities. As we discussed numerous times in this column over the past two years, a weaker US Dollar is GOOD for stocks as well as other risk assets and will contribute to the commodity super cycle (including Gold & Silver) that Mish has been projecting in her numerous “on-air” appearances of late.

With bonds rallying and the dollar sinking, stocks gapped up from the start of the day Tuesday and put in the second-best daily stock market performance since much earlier in 2023.

See the US Dollar chart below which coincides with this recent rally in risk assets:

Money Moving Into Stocks

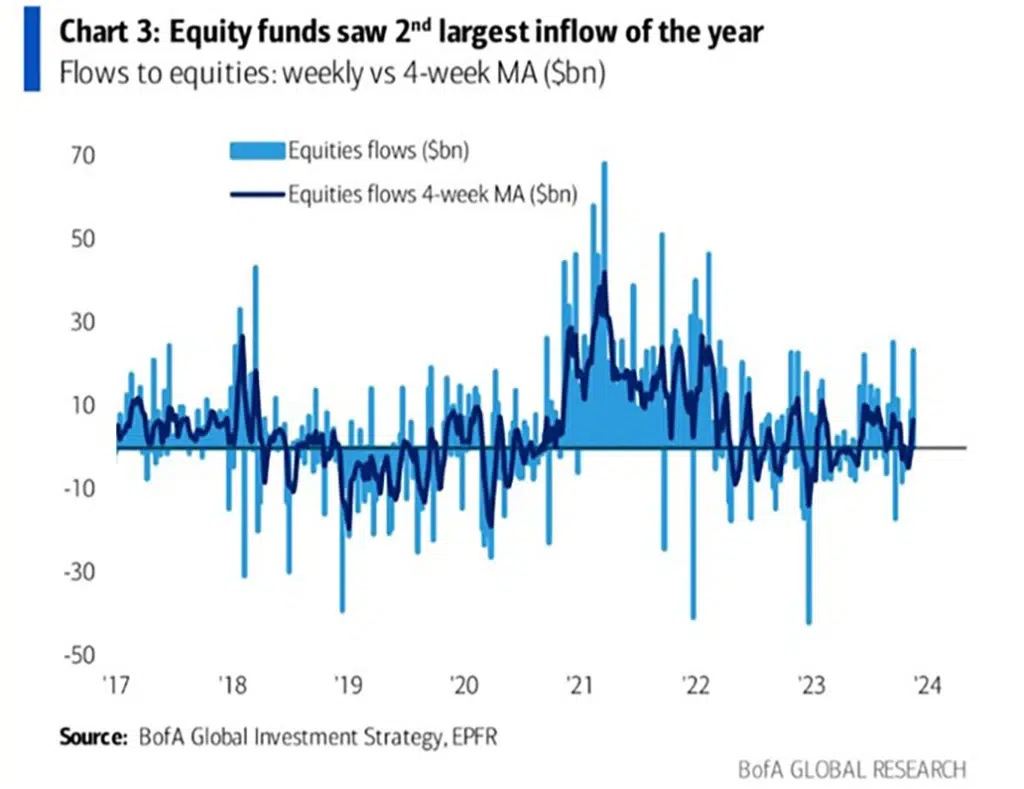

It is estimated that $23 billion of the $6 trillion in money market funds sitting on the sidelines found its way back into the market last week. These were also the second-best inflows of the year, matching what took place back during February’s explosive stock market move higher. See chart below:

The stock market is currently experiencing a positive seasonal bias helped along by cooling inflation numbers, weakness in the US Dollar and declining interest rates. But can this upward move continue?

Click here to continue reading about:

- What specific stocks and sectors fueled the rally last week?

- What are the chances that the Fed is done raising rates?

- What sectors of the market have recently hit new highs?

- How have small-cap stocks performed during this positive time?

- How have the Magnificent 7 stock performed during November?

- What do some of the MarketGauge indicators say about putting money to work in the stock market?

- Historically, how has the stock market finished the year when up more than 10% the first six months of the year?

- The Big View bullets.