Marketgauge Outlook for May 8th, 2022

Suggestions to Help Protect Your Portfolio

This is an abbreviated version of our free Market Outlook published weekly on Sunday. Recently, we’ve urged investors to get defensive, and offered 9 suggestions to protect your portfolio.

The market last week was like a good gangster movie.

It contained high drama (anticipation of Fed raising rates), a love affair with the results (Wednesday’s rally), a quick turn in sentiment with the villain getting shot (Thursday’s plunge), gangsters needing new people and recruiting (Friday’s employment reports), and another shooting (Friday’s decline).

At the end of the week, stocks sat at new lows, with interest rates at new highs.

The outlook is a mixed bag. Here’s why:

The Negatives:

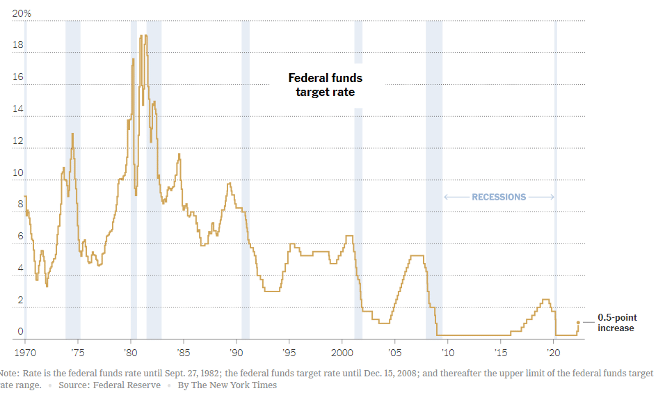

1. The Fed took action. After broadcasting that it would aggressively raise rates, it did so last week, and stocks shot up almost 1,000 points.

2. Draining excess liquidity. The Fed’s aggressive path will drain excess liquidity in their $9 trillion portfolio of bonds.

Additionally, the fastest pace of interest rate increases since 1994, supply chain problems, rising crude and commodity prices, and geopolitical risks, all make investor nervousness.

Investors now fear not only inflation, but stagflation.

3. Aging population and fear. Scared by fallings stock and bond prices, many retirees are moving to cash. Bank of America reported last week that $3.4 billion came out of stocks and $9 billion from bonds.

The Positives:

1. The Fed has begun the tightening cycle. Investors expect this to fight inflation and slow the economy down.

2. Earnings are very good. According to FactSet, 87% of S&P 500 companies have reported. 79% beat earnings estimates, and 74% exceeded revenue expectations.

3. Inflation may slowly subside. The global supply chain, exacerbated by China’s Covid policies, may resume soon.

4. Consumer demand may slow. This is the principal reason for higher inflation.

5. A healthy job market. Unemployment is at 50-year lows and high job openings (11.5 million) should help offset some of the economic slowdown.

6. Stock valuations are more attractive. Corrections of 10% or greater typically occur once in every 4 years. If we don’t see an additional 5-10% drop suggesting a bear market, it may not take much for the market to find a bottom.

7. Investor sentiment is very negative. Many firms are showing extremely negative/bearish sentiment measures at levels that tend to be where market bottoms form.

8. Commodity prices may retreat. If the economy cools off commodity prices should fall.

9. Geopolitical risk. If the Russia-Ukraine war gets sorted out soon, it should improve global supply chain issues.

Unfortunately, May to October is historically bearish, and mid-term election years tend to be volatile.

9 steps you can take to protect your investment portfolio:

1. Make sure you include CASH as one of your asset classes. Riding a downward market may put you in a deep underwater position that could take years to get back to event.

2. Diversify. Several of our investment strategies are positive on the year.

Click here to continue with the full-length article and more.