Weekly Market Outlook

By Donn Goodman

April 10, 2023

Welcome back to our weekly Market Outlook. Glad to have you. We hope you had a good week following a Happy Easter!

Like you, we are pleased that the Economy and the Markets are on firm footing. However, we are starting to see warning signs that the economy could slow drastically and/or the stock market may enter a much-needed period of consolidation or perhaps even an overdue correction.

It is worth noting that both the economy and the stock market have made solid advances over the past 18 months. However, as Mish pointed out throughout the latter part of 2023, inflation is sticky and may be elevated for a significant period of this year and into the next few years. First, let’s explore the economy and address investor sentiment and the stock market.

Warning Sign: The Economy

Friday, we had a blowout US jobs report. This eliminated and possibly delayed many of the fears of the pundits, talking heads, and analysts who have been suggesting that the economy might be in a bubble.

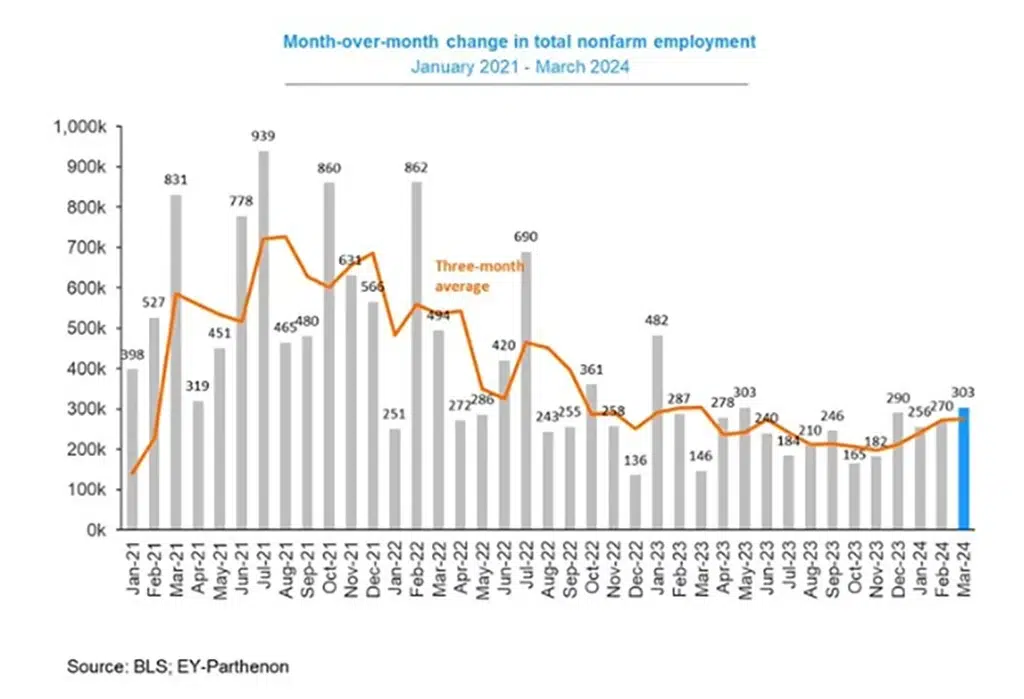

US payrolls increased by 303,000 in March, topping all estimates. The unemployment rate edged lower to 3.8%. Wages grew at a solid clip and workforce participation rose, underscoring the strength of a labor market that is clearly driving the economy right now.

“It’s hard to find anything wrong with the March jobs report,” said Steve Wyett at Bok Financial, “The only people who might be disappointed in today’s report are those looking for relief from Fed rate cuts. We still expect the next move from the Fed to be to lower rates, but there is little sense of urgency at the moment”. See chart below:

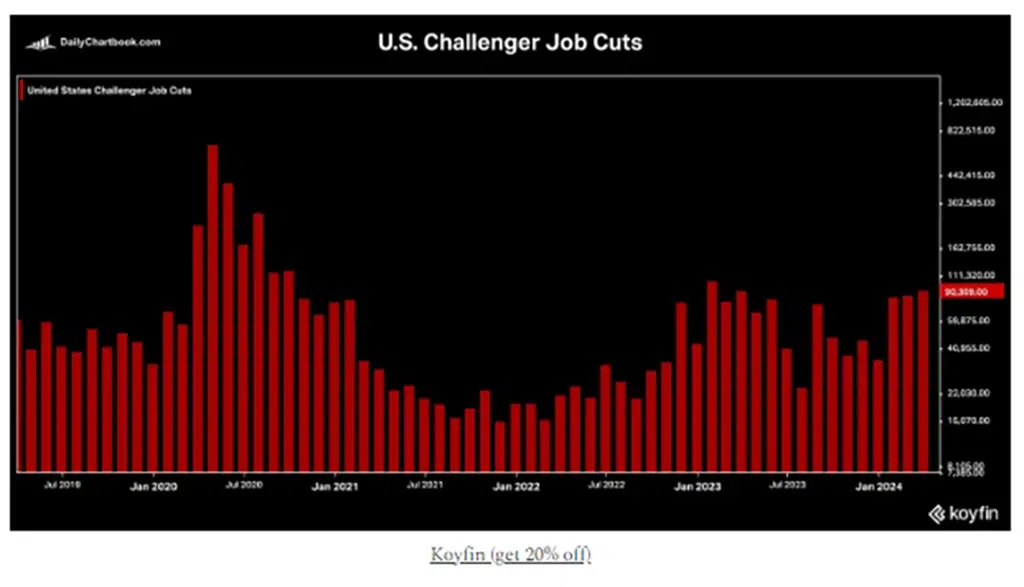

Warning Sign: In the meantime, US employers announced more than 90,000 job cuts in March, the most since January 2023. Total job cuts announced in Q1 were down 4.9% from Q1 2023 but up 120% from Q4 2023. This is one of the warning signs that higher interest rates and, even more importantly, higher wages may be affecting corporations’ efforts to begin cutting staff.

Additionally, the integration of AI into corporations’ labor forces is expected to increase productivity. This may eventually allow companies to do more with fewer people. See job cut chart below:

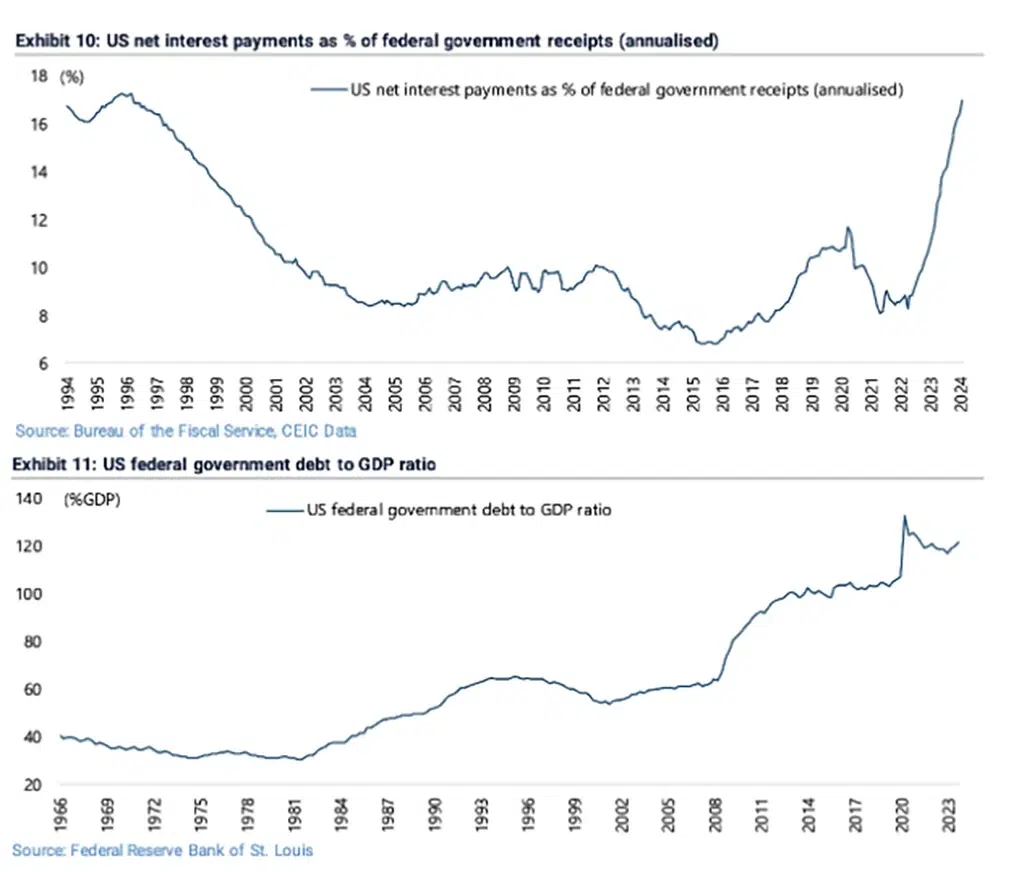

Warning Sign: Deterioration of the ability of the Government to pay its debt. US net interest payments have reached the highest level (top chart below) since March 1996. Back then, debt-to-GDP was just 64%, whereas today, it is 122%. Both charts can be seen below:

Our concern: In November 2023, Jerome Powell (Chairman of the Federal Reserve) announced that they plan on several rate cuts in 2024. Some investment firms and analysts interpreted this (and the dot plan) to mean there could be as many as 6 rate cuts throughout 2024, starting as early as March 2024.

Back then, you will recall that the stock market took off given the forecast that the Fed would loosen monetary policy and that inflation would revert to the Fed’s stated objective of 2.0%. We thought otherwise and have gone on the record that we did not see any rate cuts happening until midyear, at the earliest. We also thought that there might be only 2-3 cuts in 2024, not the 6 many people bought into late last year.

All through the fall and recently, we have stated “higher for longer”.

Also, last fall we showed the 10-year Treasury charts trending downward below 4.0%. We cautioned our subscribers that we might see the 10-year rate back above 4.0% given our belief that inflation could re-accelerate in 2024. Mish wrote several pieces that show what happened in the 70s and our belief that inflation will not come down so soon. Friday, the 10-year closed at a multi-month high of 4.4%. Real inflation as reported last month, is still running close to 3.0%, far from the Fed’s stated objective of 2.0%

Warning Sign: No rate cuts this year.

Thursday, US Federal Reserve Bank of Minneapolis President Neel Kashkari said interest rate cuts may not be needed this year. This was probably the last thing impatient investors wanted to hear. It’s good for savers, but bad for stock market investors.

He called the January and February inflation readings “a little bit concerning” and said he needs to see more progress on prices to gain confidence that they’re moving toward the Fed’s 2% target. “In March, I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target”, said Kashkari on Thursday. “If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.”

The market sold off, with the S&P down over 1.2%, the QQQ down over 1.5%, and small cap stocks, the least stretched of the indices, down about 1%. On Friday, a few other ex- and current Fed Governors gave their opinion (after the jobs report) that inflation was still trending down, and the market cheered that the prospect of interest rate cuts was still on the table.

There were comments in the news after the dust settled Friday from the jobs report issued on Friday. Here is one which we happen to agree with:

There’s ‘no way’ the Fed is cutting 3 times this year, says Craig Johnson

Piper Sandler managing director and chief market technician Craig Johnson reacts to Federal Reserve Chairman Powell’s remarks on rate cuts, oil prices and jobless claims.

More Warning Signs: Investor Sentiment and the Stock Market

If you are a regular reader of this weekly column, then you are well aware that in the past few weeks, we have published numerous historical charts showing that when the first three months are positive, the year is positive, and what occurs after 5 straight positive performance months. All good ammunition for staying long the markets.

If you did not have a chance to read last week’s Market Outlook or would like to review it again, please click here to do so.

You should also know that most of the MarketGauge indicators are currently showing “risk on”. This will be further elaborated in the Big View section and on Keith’s video that follows.

There are warning signs, however.

Here are 8 warning signs that the market may move sideways or correct in the next few quarters.

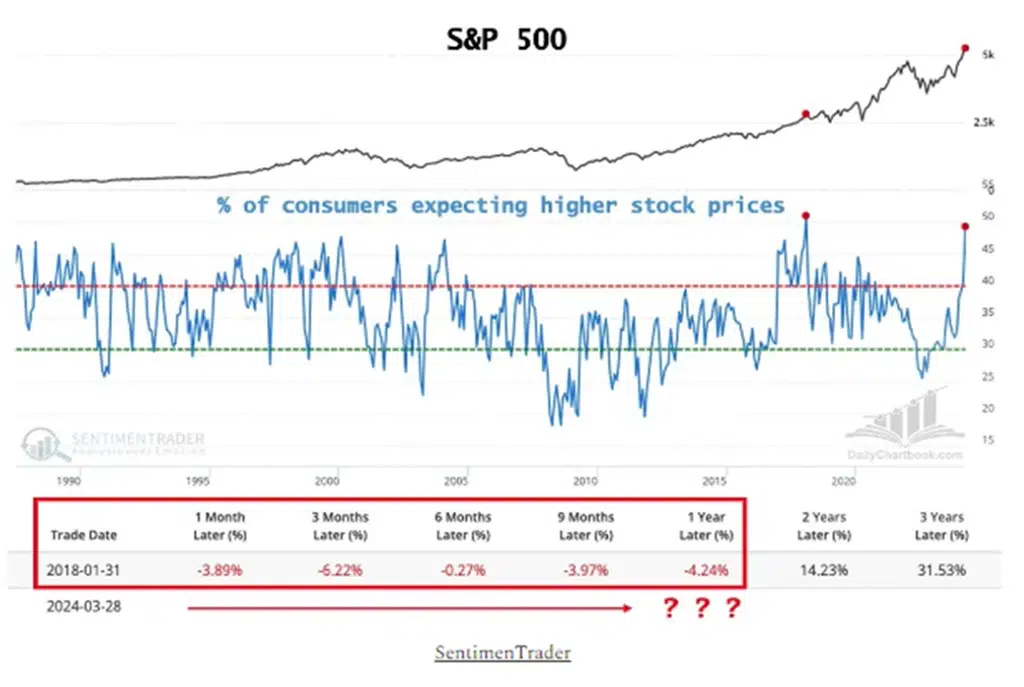

1.) The % of consumers expecting higher stock prices is at 49.3% per the Conference Board. That number has only ever been higher once in January 2018 at 51%. Following that instance, the SPY generated negative returns over the next 1, 3, 6, 9, and 12 months. See chart below:

Don't Get The Weekly Newsletter? Join Here:

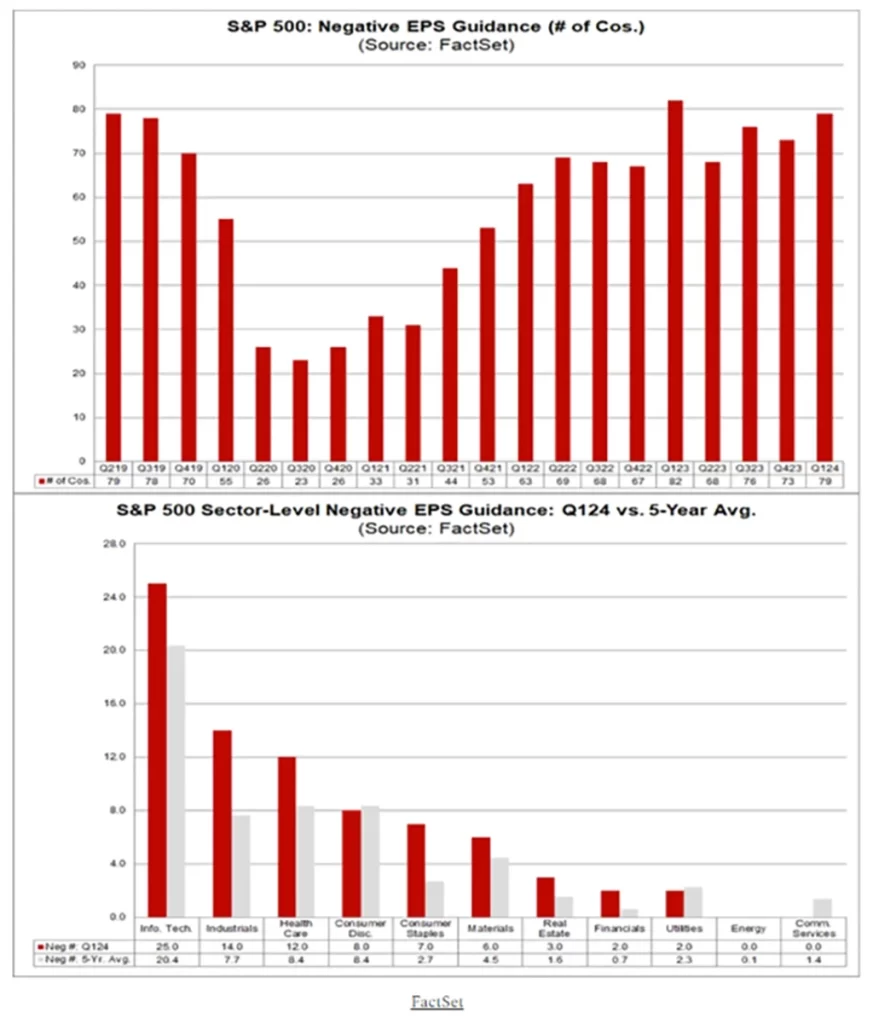

2) The first quarter’s earnings-negative guidance. Both the number (62) and percentage (71%) of S&P 500 companies issuing negative guidance for Q1 rank as the second highest ever. YES, earnings growth this past quarter had been higher than expected as companies reported good numbers. However, it doesn’t appear this is sustainable for the remainder of 2024. See earnings guidance chart below:

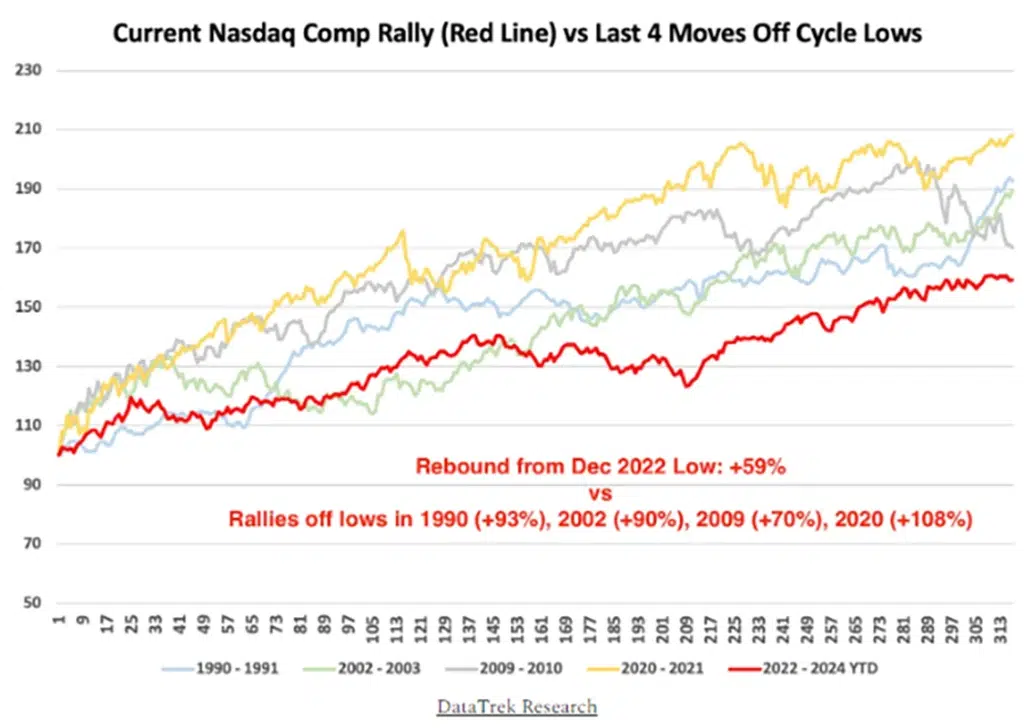

3.) Nasdaq vs. cycle lows.The Nasdaq’s “performance since its December 2022 bottom is lagging every rally off its 4 prior cycle lows.”

4.) Investor Sentiment is at an extreme. Historically these extremes are typical when we begin to see signs that the market has peaked and may go into a consolidation or corrective period. The warning signs show sentiment readings that are very bullish, AND the bears are at a low extreme, creating the bull-bear spread to be at an extreme ratio. See chart below.

Use the links below to continue reading about:

- Additional warning signs that the market may stall or correct

- The evidence and reemergence of a commodities super-cycle

- The Big View bullets

- Keith’s weekly market analysis video

- And more