May 17, 2023

Weekly Market Outlook

By Donn Goodman and Keith Schneider

Investors are hoping that profits will show up soon.

Unfortunately, hope is not a strategy, and at least five dark clouds loom on the horizon. Let’s explore each one together.

- The First Dark Cloud: Corporate Earnings

According to Fact Set, 92% of S&P 500 companies have reported their Q1 2023 earnings results with 78% beating their earnings estimates and 75% reporting revenues above estimates.

This was 4% better than the 6% decline expected in corporate earnings. Wall Street analysts had modeled all the earnings scenarios and determined that we were already in the middle of a six-month earnings recession. We learned over the past few weeks that their models were correct. This past quarter (Q1) was indeed a struggle for many of America’s biggest companies.

**************

Discover Your Investing Strengths

Are you investing in a way that leverages your strengths? These 10 simple questions will uncover how to approach the markets in a way that plays into your strengths so you succeed faster and with less effort.

**************

That quarter is over. Guidance from the hundreds of conference calls that took place after earnings announcements was far lower than expected. Many of these negative calls resulted in a sudden decline in share prices, even though the company’s earnings may have beaten estimates.

No catalyst for growth.

What came through from corporate CEOs addressing earnings was that there has been NO miraculous recovery in the past year’s business cycle and trends. If anything, we may get a few unwelcome shocks in the near term, which could saddle the current market malaise a bit longer.

Some estimates have the current quarter experiencing a 5% or more earnings decline.

Therefore, it is easy for many analysts, portfolio managers and people managing money (including Bank CEOs like Jamie Dimon) to think we are headed for a recession and negative growth for the remainder of 2023.

It is also likely why many professional investors and economists are betting on a decline in interest rates in the latter half of the year. After you read the next section on inflation, you may agree with our assessment that interest rates are likely to stay higher for longer.

2. The Second Dark Cloud: Inflation

The Market and Economists May have it Wrong!

We think the markets (and analysts) have it WRONG about inflation. We are not alone.

Last Wednesday, the Consumer Price Index (“CPI”), the most widely watched inflation indicator, came in at 4.9% (year-over-year) for April. Yes, that is lower than the 5% for March and Yes, that is the 10th straight monthly decline in the annualized rate of inflation.

The stock market had a positive reaction to that news. The NASDAQ rose 1% on Wednesday (May 10th) and the S&P 500 was up about 0.5%.

Based on the chart below, it is plain to see why the market would react as if inflation is falling.

However, there is more to the inflation story.

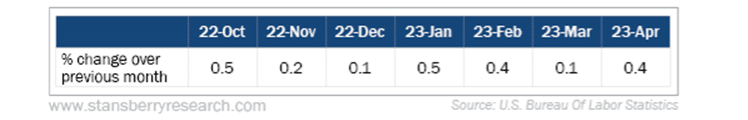

The CPI rose 0.4% in April, in line with expectations.

But wait a minute, the March month over month number was 0.1%. April was 0.4%. Would you say that inflation is falling, staying flat or rising? Look at the chart below:

To me it seems that inflation is steadily continuing to rise with a couple of lower months. Those are likely due to energy prices coming down. However, food and rents continue to trend sideways to upward.

Therefore, one could easily conclude that inflation remains flat and is not really declining.

Core CPI is even more ominous looking.

Click here to continue reading to discover the rest of the inflation picture and three more dark clouds over the equity markets that you should be aware of, according to our latest analysis at MarketGauge.