Weekly Market Outlook

By Geoff Bysshe

MarketGauge Pro

December 18, 2024

Last week the stock market’s annual Santa Claus Rally came under attack by the bond bears. The powers that be behind the stock market are fighting back, but this situation looks tenuous. Keith covers many of the technical details in the Big View video this week, but first let’s look at the big picture.

Considering the fact that participation in the stock market by American households is at an all-time high (shown below), there is a lot at stake.

Fighting Back

On Friday, Nasdaq Global Indexes, the overseer of the Nasdaq 100 index on which the QQQ ETF is based, beefed up its firepower by adding the largest corporate holder of Bitcoin, Micro Strategy (MSTR), and one of the hottest AI stocks, Palantir (PLTR) to the index along with Axon Enterprises (AXON). MSTR and PLTR are up over 500% and 375% this year. You can find the official notice of all the changes here, but what they won’t point out is this…

By most accounts, MSTR is on the list of the top 3 largest holders of Bitcoin, and the majority of its balance sheet is Bitcoin. Its mission, as stated in a recent press release is, “Our focus remains to increase value generated to our shareholders by leveraging the digital transformation of capital. Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.” As a Bitcoin Treasury Company, we plan to use the additional capital to buy more bitcoin…”

As you’d expect, this makes MSTR a highly leveraged, often very correlated play on Bitcoin.

Approximately 3,300 institutions own the QQQ ETF, and it is one of the most popular ETFs for individual investors. If you have 401k, or a pension plan, you’re likely to own the QQQ and now, by proxy, some Bitcoin.

What’s in your portfolio?

No need to be concerned, if MSTR falls apart, it will get kicked out of the QQQ like the once high-flying AI hardware maker, Super Micro (MSCI), and the COVID success, Moderna (MRNA) that were both replaced on Friday, along with Illumna (ILMN) to make room for better performing stocks. Additionally, the QQQ has a long history of adding new members when their stock prices are “inflated” but based on the performance of the QQQ over the long run, it works.

The good news, perhaps, is that now you have an easy, very diversified way of owning some Bitcoin, buy QQQ. To be clear, this is not a recommendation.

The Santa Claus Rally

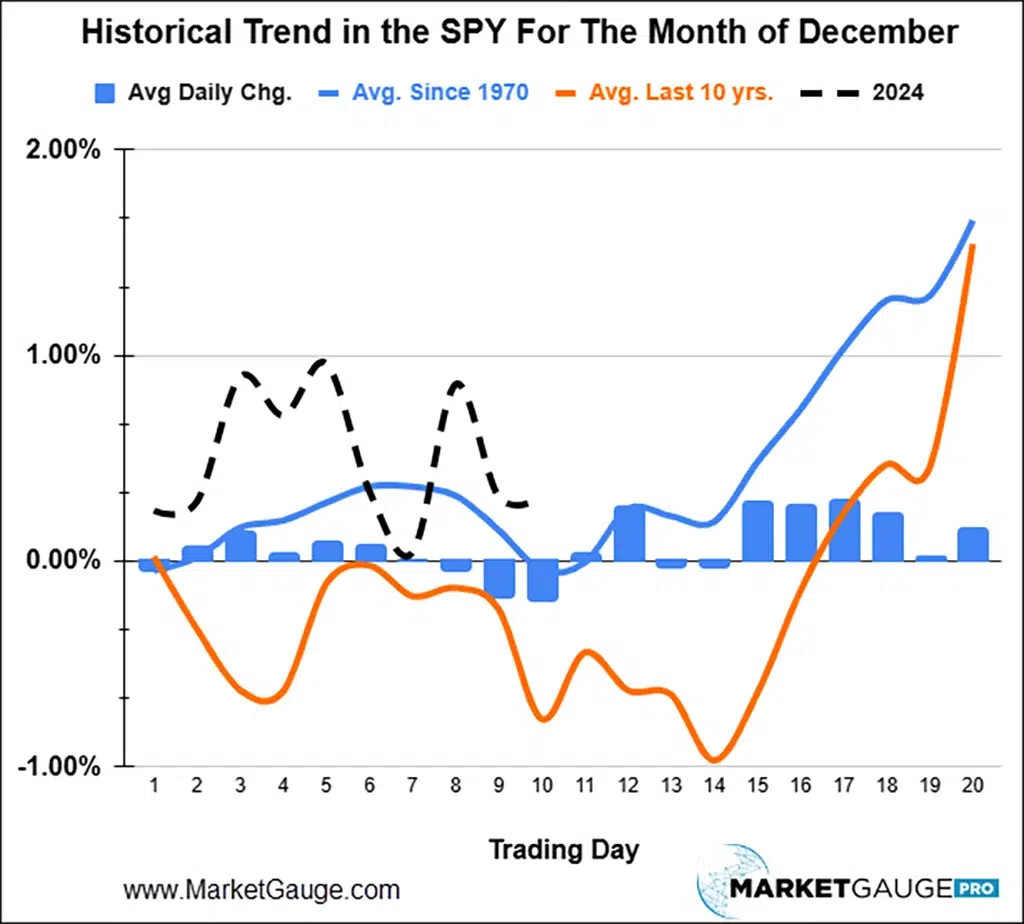

In case you’re not aware, the stock market has a tendency to rally in the last two weeks of the year. Looking at the data since 1970, December is modestly positive before its year end push higher, but in the last 10 years, it’s gotten off to a weaker start. The chart below shows this pattern with both time perspectives along with the black dashed line indicating how 2024 is following along.

Don't Get The Weekly Newsletter? Join Here:

The Threat

While it may not have been obvious to most people, last week, stocks were boring compared to the fireworks in the bond market.

As you can see by the chart below, TLT is in the “biggest percentage mover – DOWN” position, and the distribution of returns in the various assets has a message that investors should pay attention to.

It wasn’t just a bad week for the bonds. It was the worst week in over a year.

The chart below shows every move of 4% or more, highlighted in green or red to illustrate their unusual size and rarity. Bearish weeks exceeding -4% have only occurred 11 times since the peak in TLT (bottom in long rates) in the last 4 years.

Is Inflation to Blame?

With such a big move by the bonds in a week that released two of the three most important inflation measures, it would be easy to blame inflation.

At the current point in the economic cycle, there are 3 basic explanations for rates to rise and bonds to fall. Strong economic growth, increased fear of inflation, and fear of Federal deficit funding problems.

Since it was CPI and PPI week, let’s focus on the inflation idea.

The theme in both reports is that inflation’s descent is slowing down and potentially turning back up. However, it’s doing so without posting any significant upside surprises.

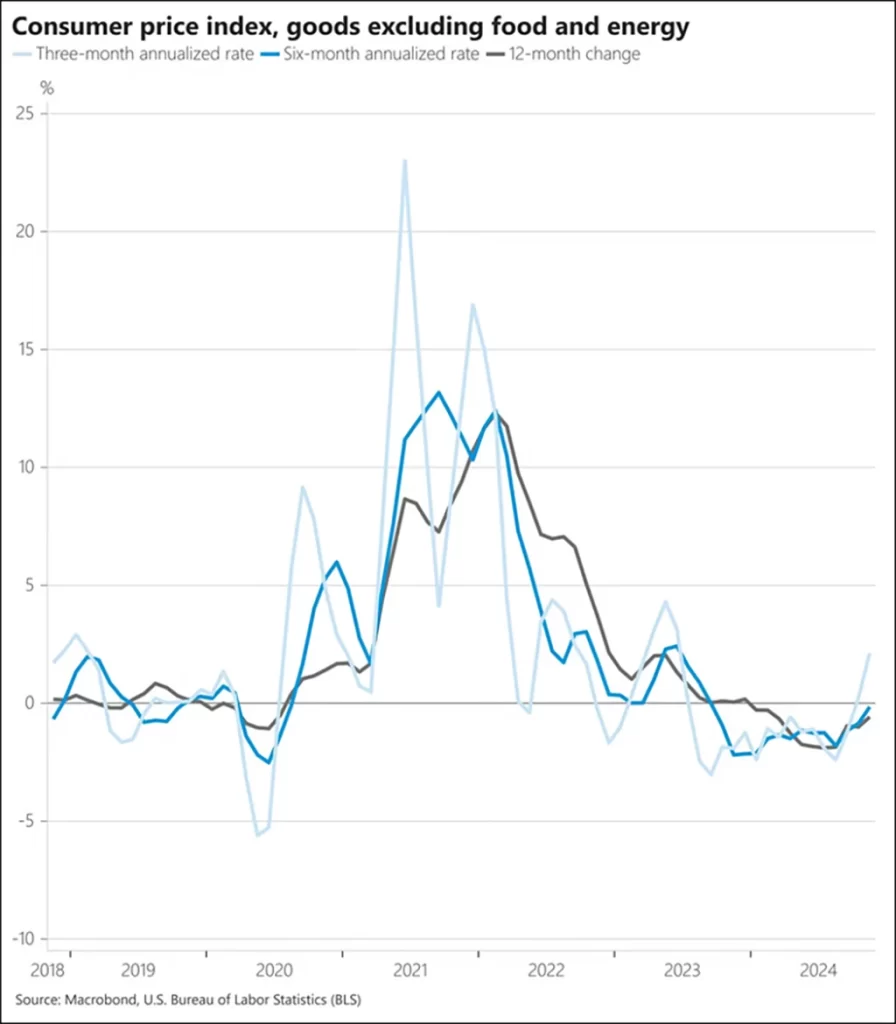

In the case of CPI in the chart below, the trend is clearly leveling out and potentially turning up in the most meaningful way since its peak in 2021-22.

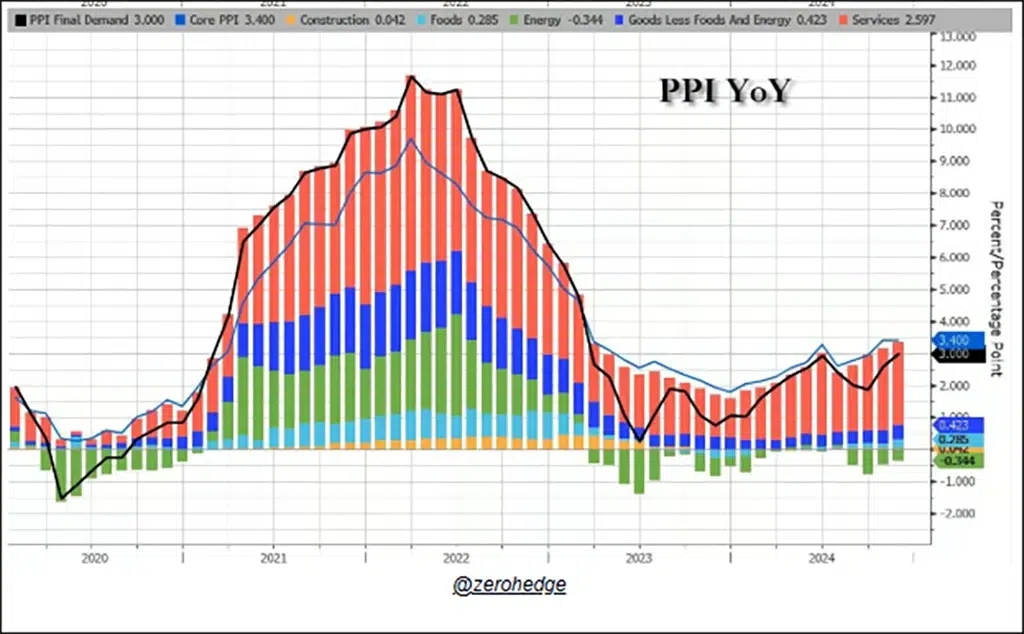

The same “leveling out and turning up” pattern is evident in the PPI data (see below).

So, is this turn-up enough to rattle the bond market?

The market has a history of surprising investors.

Use the link below to continue reading about:

- The bond market’s problem for stocks

- Optimistic business

- Bullish trends for 2025

- The Big View Bullets

- Keith’s weekly market analysis video