Weekly Market Outlook

By Donn Goodman

MarketGauge Pro

July 03, 2024

Thanks loyal readers and those as well who may be reading for the first time. Glad to have you with us. We wish you a happy upcoming Independence Day this week. This short poem by Julia Ann Moore, entitled Fourth of July, sums it up so well:

Fourth of July, how sweet it sounds,

As every year it rolls around.

It brings active joy to boy and man

This glorious day throughout our land.

Of course, it was written long ago, so we want to make sure that we extend our heartfelt wishes for everyone, including girls and women to enjoy the holiday and more importantly, that we all remain grateful for the independence we enjoy in this country and to never take it for granted!

Speaking of independence. This past week while doing some research to assist me in writing this column, I thought long and hard about what independence means to me and my family. Besides the freedom for us to do what we want and be who we want, also what came to mind was the freedom to learn and practice how to invest more effectively and with better results.

We have many subscribers who go way back in time that have been using investment tools and investment models that MarketGauge has been offering. You may not be aware of the fact that MarketGauge was started over 25 years ago and was one of the first successful investment services offered on the internet.

As my grandfather used to say to me “An overnight sensation only takes about 15 years”. So, you could say after all this time MarketGauge is an overnight sensation.

One of the long-term users of MarketGauge investment products was visiting our offices in Santa Fe the past few days. He mentioned to Keith and Geoff how much the MarketGauge tools have helped him become a better trader and that he feels that he has developed the “freedom” to enjoy trading now that he is in retirement from his successful high level corporate career. He claims that he is having more fun being able to successfully navigate the markets now and to handsomely profit from our tools. Are you doing the same? Drop us a line and let us know what is working and what you might need more assistance with.

If you would like more information on the many different MarketGauge investment tools and strategies, please reach out to Rob@MarketGauge.com. Or, if you are a professional, advising other people on their investment portfolios, please contact Ben@MarketGaugePro.com.

Let’s jump right in to the first half of 2024.

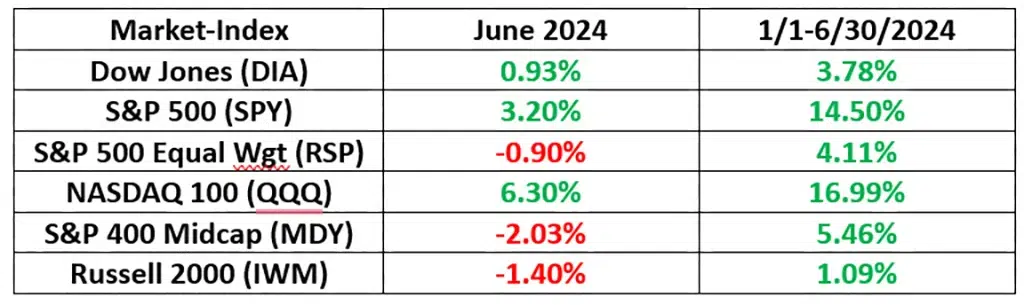

Before we discuss the upcoming month of July, let’s take a quick look at how the different market indices have performed so far in 2024. I think most economists, Wall Street analysts and many market prognosticators would admit they are very surprised at the performance for the last month (June) and year-to-date 2024 so far. First, let me summarize the first 6 months of 2024 and then provide a table showing the actual performance.

- Markets have been resilient in the face of higher interest rates and a sub-par bond market.

- After spiking earlier in the year, commodity prices have been retreating, suggesting that lower inflation and possibly deflation is coming.

- Most of the inflation indicators are trending down giving credence that the Federal Reserve will likely cut their overnight lending rate sometime in the next 6 months. This is supporting many company’s high P/E multiples.

- Volatility in the markets has remained low. In fact, there have been no unusual spikes which would accompany a significant correction.

- It has been approximately a year since we experienced a 2% or greater one day decline in the S&P 500.

- We keep making new all-time highs (ATH) in the S&P 500, many more than expected by most Wall Street analysts.

- Most of Wall Street was surprised that the earnings for the S&P 500 for Q1 (reported the past 3 months) were well above expectations. 79% of S&P 500 companies beat their earnings estimates with 61% also beating their top line revenue estimates.

- The unfolding AI revolution is not only increasing expectations for future revenue and earnings, but getting investors excited at the prospect of a huge tidal wave of expanding technologies which support these lofty stock prices and high multiples.

- The economy has stayed strong and is currently softening enough for most analysts to still believe we could avoid a recession and have a “soft landing”.

Most of the above bullet points have helped lift the stock market (S&P 500 & NASDAQ 100) to a positive and surprising first half return. See the table below:

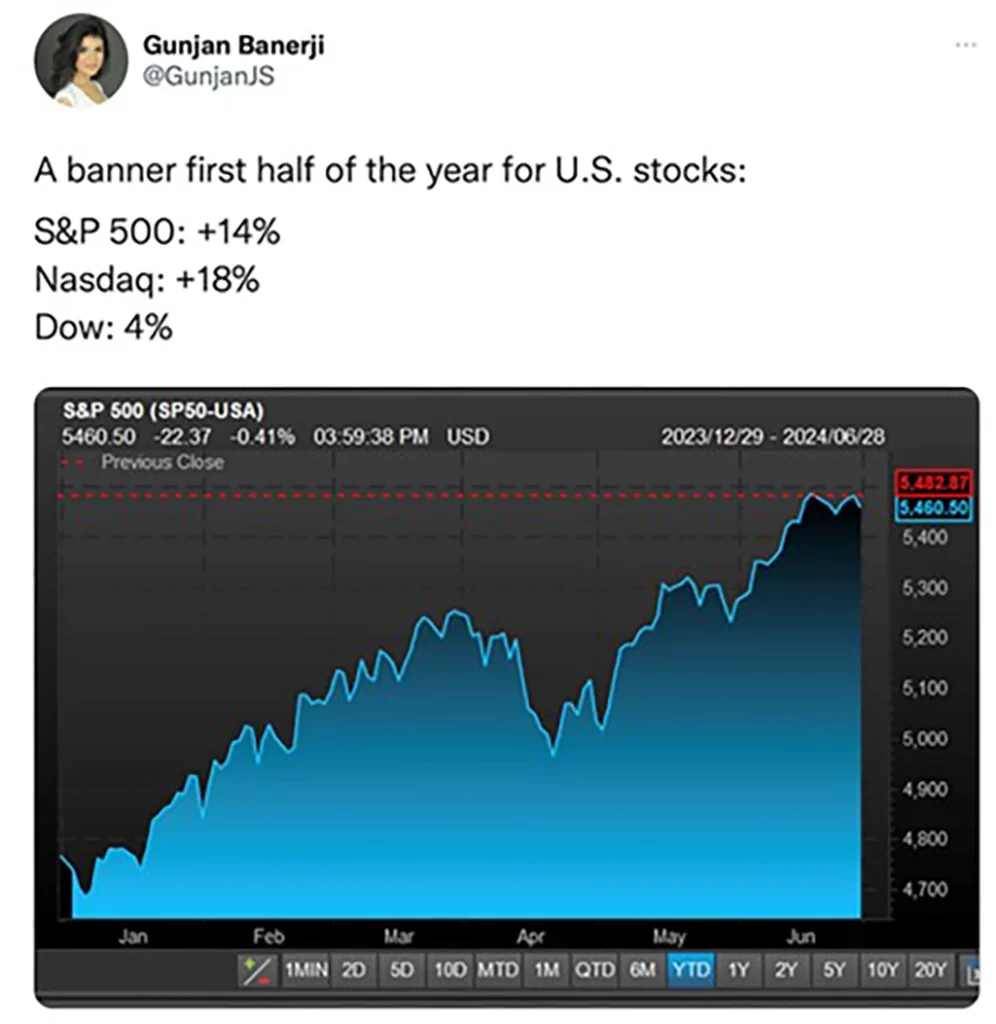

I am surprised by these returns. Given the higher interest rates and Fed’s effort to slow the economy down, mid-teen returns are pleasant surprises. However, it is important to note that the two indices (SPY & QQQ) are heavily influenced by a few of the biggest stocks and given the meteoric rise of Nvidia and continued move up of the top 5% of the S&P 500 cap weighted index, it may not be a shocker. The good numbers for the S&P and the NASDAQ are illustrated in the graph below:

Don't Get The Weekly Newsletter? Join Here:

So far this year, it has been all about the mega-cap stocks that have driven most of the returns of the S&P 500 and the QQQ. I wrote extensively about the concentration effect of the mega cap stocks in the past two issues of Market Outlook.

Use the links below to review them:

“Can The Bull Market Keep on Kicking? Or Is It Growing Tired?

“Celebrating the All-Stars Winners!”

Please notice the table above showing the equal weight S&P 500 (RSP), the Dow Jones (DIA) and the Small and Midcap indices that have had surprisingly low returns so far this year. This reflects the more equal weighted narrative that many stocks are not yet participating in this rally. For small and mid-cap stocks this also reflects the cost of borrowing, which remains high.

While small-cap stocks (Russell 2000 index – IWM) have gone nowhere this year, they are trying to break above the 210 magical number that might signal they have “broken out” and begin a healthy move up. Most analysts covering these smaller companies believe this will happen as soon as the Fed cuts rates. See graph below:

The Negative Analysts

Before we get into the current positive stock market bias and historical July pattern, it is important to point out that there are plenty of market analysts and pundits who remain negative and continue to cite “their proof” that the markets are setting up for a significant correction or meltdown.

Use the link below to continue reading about:

- The bullish impact of bearish analysis

- Market breadth in commodities

- Why July is known as the most bullish month

- The Big View bullets

- And More