Good As Gold Continued

Signs of a Bullish Bias

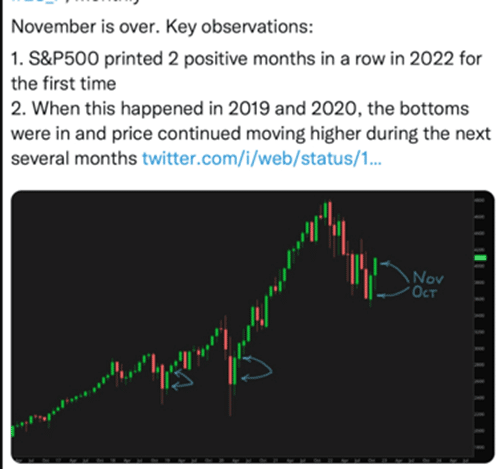

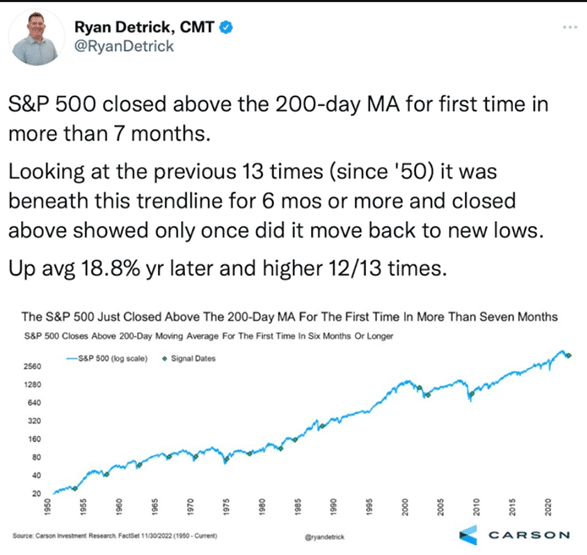

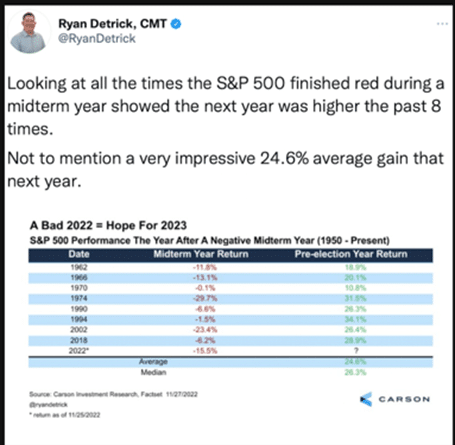

As we enter December, it is good to note that we just came off two positive, back-to-back months. This type of action, especially in a midterm election year (of a first term President), suggests that a more profitable and positive stock market may be ahead. Please note a few charts that sum this up:

One of my favorite CMT (Chartered Market Technicians) is Ryan Detrick. He put out a few things this week that give a favorable picture going forward:

However, Inflation Persists

While most of the above information may give investors a sense of renewed optimism, it is important to remember that we remain in an elevated inflationary environment. The Fed has raised rates aggressively in 2022.

This past Wednesday, Chairman Powell said it was likely the Fed could begin to moderate the future rate hikes. The market rallied. It liked the news until Friday at 8:29 am arrived and then…

Came a hot job report. New job creation was well above expectations. The unemployment rate stayed at 3.7% and wage gains climbed to 0.6% well above the market’s expectations of 0.3%.

The strong wage gains in the U.S. November jobs report put out Friday may have just put another 0.75% interest rate hike back on the table for the Federal Reserve’s policy meeting in two weeks.

The market shook off the news. After opening down 1%, the market recovered most of the day’s losses. There is a positive bullish bias right now.

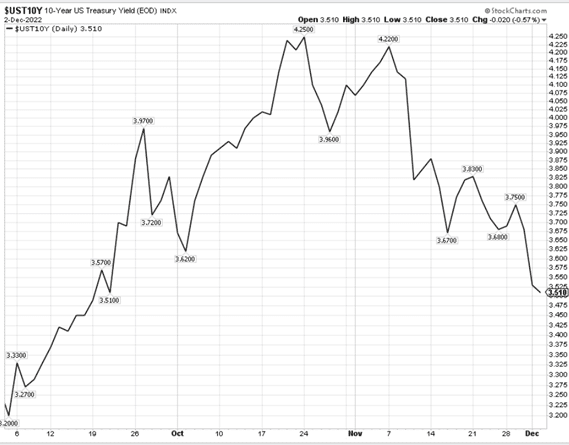

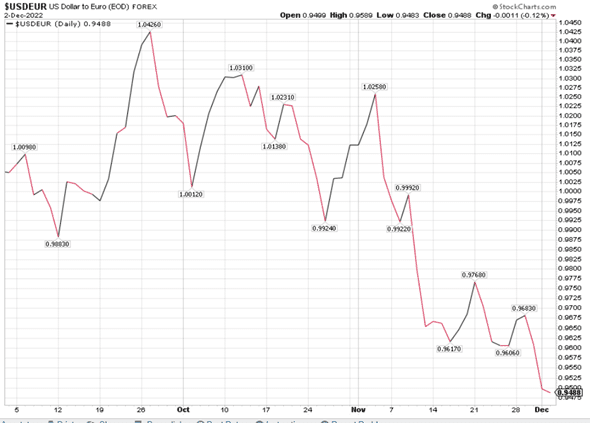

The long bond (which we are invested in through the ETF: TLT) rallied by day’s end and continued the sharp decline of interest rates on the long end. The 10-year rate has now declined from 4.25% in October to 3.5% in six weeks. This, along with the US Dollar’s decline in value has helped push stock prices higher. See chart below of the 10-year yield and the US Dollar (versus the Euro):

After hitting multi year highs in value against the Euro (and other worldwide currencies such as the British Pound, the Japanese Yen, and others) the US Dollar has declined about 15%. This has had a positive effect on stock market valuations as it is perceived to be positive (and additive) to large multinational corporation’s earnings. The S&P 100 companies currently receive over 30% of their revenue (and earnings) from international trade and a weaker US Dollar is beneficial for their future earnings.

Sorry, we couldn’t fit the whole Market Outlook here, so

click here to see what’s missing, such as…

…Will the Positive Stock and Bond Market Continue?

…The Metals Markets Just Got Shinier

…Looking back (all that is Gold may not shimmer)

…Great trades of 2022

…MarketGauge’s Big View technical insights in bullets and video

…How you can beat the market with simple diversification strategies