Weekly Market Outlook

By Donn Goodman

MarketGauge Pro

July 24, 2024

Welcome back readers. Glad you are joining us.

I began the week traveling to Chicago for a meeting. For those of you unaware, my son, Zach, works for our asset management company, MG Asset Management. He lives and works in Chicago.

He had called me on Monday to tell me about the incredible lightening strikes that occurred in Chicago on Sunday night. (see above). Not sure it had ever happened before, but the lightning hit the three highest buildings in Chicago simultaneously. (The Hancock Building and the Trump and Sears Towers)

Maybe it was a preview of what was to come in the stock market during the upcoming week.

The stock market continued its most recent rally and euphoria in technology stocks on Monday and Tuesday of this past week. Two distinct market moves occurred on Monday and Tuesday that attracted investors’ attention. The Dow was up over 2% and small cap stocks continued their thrust higher, up over 5%. That followed the previous week’s historic move in small cap stocks.

The S&P 500 and the NASDAQ 100 (QQQ) were up but less than 1% for the Monday-Tuesday rally. If you haven’t reviewed last week’s Market Outlook as yet, you may go here to review (or reread) the commentary on the historic move of small-cap stocks.

The markets turned on a dime Wednesday-Friday.

Wednesday, the market felt the beginning of a summer storm. There were several reasons that the talking heads and Wall Street analysts gave why the market sold off. These included geopolitical commentary on whether the US would support Taiwan if they were attacked by China. This also led to additional commentary as to whether Taiwan Semiconductor could retain its lofty valuation if it was wiped out in a Chinese attack of the island. Dire thoughts.

Additional questions were raised related to the possibility of a change in the White House administration (Democrat to Republican) and the impact that might arise from tough tariffs, especially on the technology industry. I also think that the uncertainty surrounding whether the current President is fit to run has had a negative effect on the market.

To summarize just how negative Wednesday’s move in tech stocks see the heat map below:

Technology stocks, especially semiconductor issues over the past 10 months have been on a tear. You will also recall that two weeks ago I mentioned that the best month of the year to invest in the broad market is July. However, historically, most of the return comes in the first half of the month.

Wednesday’s tech sell-off continued for the rest of the week. Instead of the positive returns of Monday and Tuesday, the tech heavy NASDAQ 100 (QQQ) stocks were down 5% in the last three days.

Is this just a passing storm or more serious?

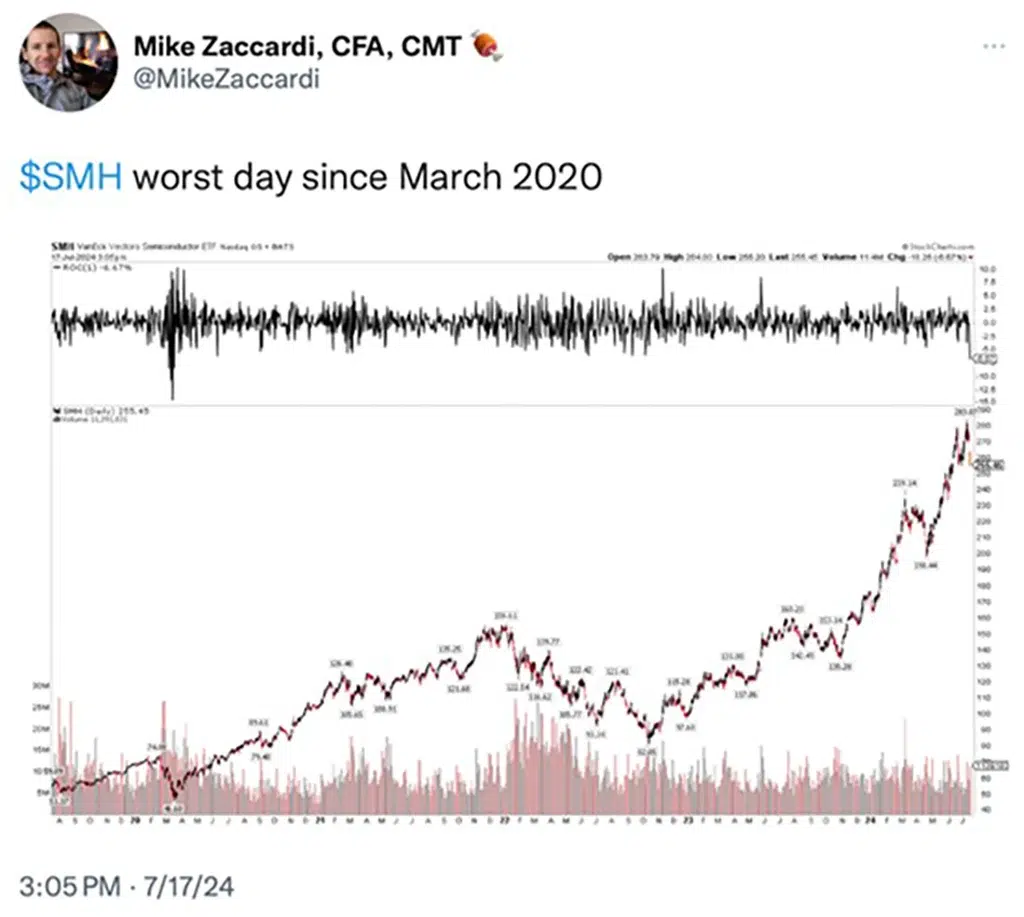

The week felt like a hurricane to some. A lot of key stocks, especially chip stocks, dropped hard. Nvidia was down over 8%, Meta, Alphabet and Amazon all dropped 5% or more. Apple, Tesla and Microsoft…all down on the week. See the semiconductor chart below:

Don't Get The Weekly Newsletter? Join Here:

The Friday cybersecurity shock.

Even though the geopolitical rhetoric had started the tech sell-off, nobody was prepared for the Crowdstrike fiasco that hit on Friday. This started from a disastrous software update which prevented the Microsoft Windows operating system from working around the world. Millions of businesses, including the transportation sector and healthcare (hospitals had to suspend important surgeries) took the brunt of the problem.

The volatility index or “VIX” soared 32% this past week into elevated territory, triggering nervousness from years of dealing with back-to-back investment shocks. This was the worst week on Wall Street since April, if you can believe that. Just 90 days ago, we will remind you, the market snapped back quickly and went on to new highs in May and June.

At the end of the week, here is what the indices looked like:

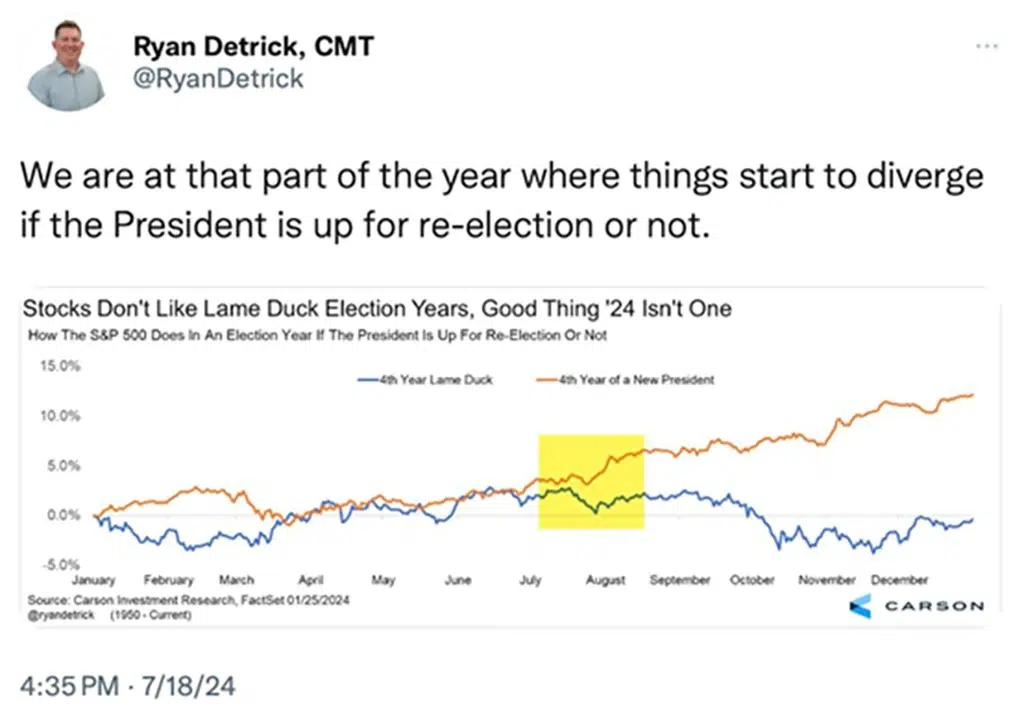

It is important to remember that we are in an election year with newfound uncertainties. We are likely to feel additional turbulence and geopolitical risk with the potential of a new administration and/or what might happen with the current President and his administration.

We also find ourselves at that part of the year when the market begins to have divergences. See chart below:

Will the Fed lower interest rates?

Much of the market’s recent exuberance has certainly been tied to the belief that the Fed may cut interest rates as soon as the September meeting. We covered this in last week’s Market Outlook.

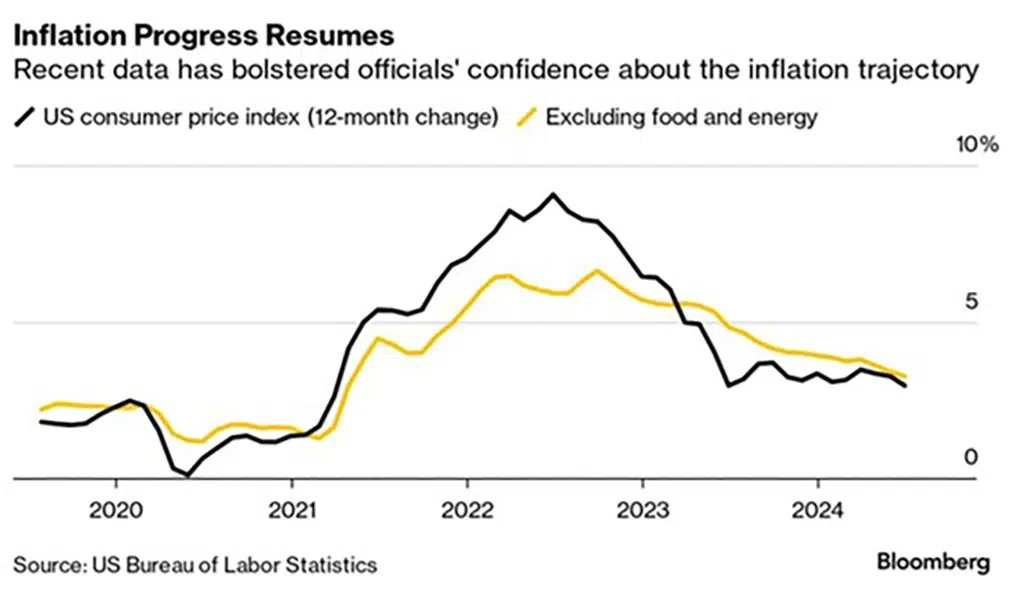

Most economists now believe that short-term rates are too high as compared to the rate of inflation which continues to trend down (see chart below):

For more than two years now, inflation has eclipsed everything else at the US Federal Reserve. The US central bank appears ready to cut interest rates and the futures betting pool is showing an almost 100% chance of that happening. This and expected good earnings have been driving a lot of the recent gains in the stock market.

Additionally, the business community, especially commercial real estate, mortgage brokerage, home sales organizations and homebuilders believe rates are too restrictive and continues to put their businesses into a stand-still. They have been pleading for lower interest rates. I also suspect that the current Administration understands the value of driving a soft (not hard) landing and has also been secretly pleading for lower rates.

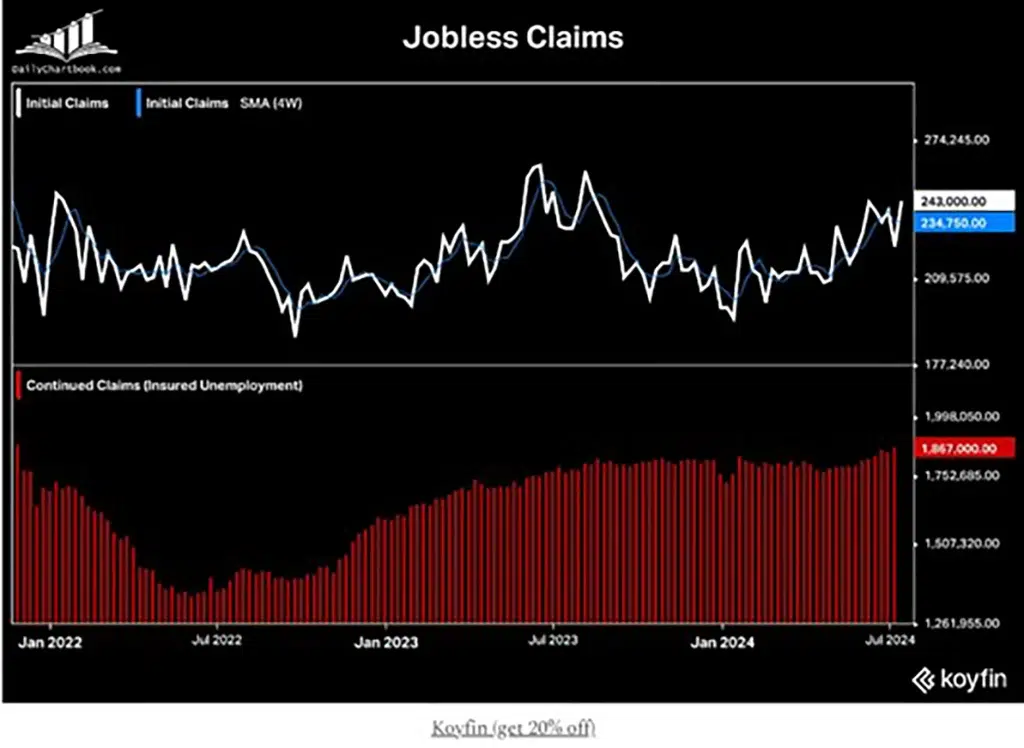

Another factor is that the Fed has been closely watching and may be an important catalyst for them to make the ultimate decision to lower rates, is the employment market. Given recent softening in the job market, this may provide additional fuel to give them the runway they need to begin lowering rates. See chart below:

Signs of softening in the labor market as both initial and continuing claims rose more than expected in the week ending July 13. The former tied a YTD high while the latter hit the highest since November 2021.

It is not a done deal that the Fed lowers rates before year end, even though the futures markets are suggesting that. Fed officials still want to see monthly price numbers continuing to trend down towards the 2% annual inflation goal before they commit to lowering borrowing costs from a two-decade high.

I truly believe in the end however, that the Fed Chairman and his colleagues remain dovish and want to do everything possible to avoid the US economy from a potential hard landing. That is something they could take credit for in the years ahead.

Rotation has kicked in.

Use the links below to continue reading about:

- Market Rotation

- The Small and Mid Caps Rally

- Investor Sentiment Readings

- The Big View Bullets

- Keith’s Weekly Market Analysis Video